By 2030, 1 in 4 existing LIHTC units will lose their affordability restrictions. What can we do today to plan for this future?

The Low-Income Housing Tax Credit program started in 1987 as a way to incentivize the creation of new, affordable apartments across the nation. Since then, over 3 million units have been built or preserved. While this longevity helps demonstrate the effectiveness of the program, it’s now creating a significant problem.

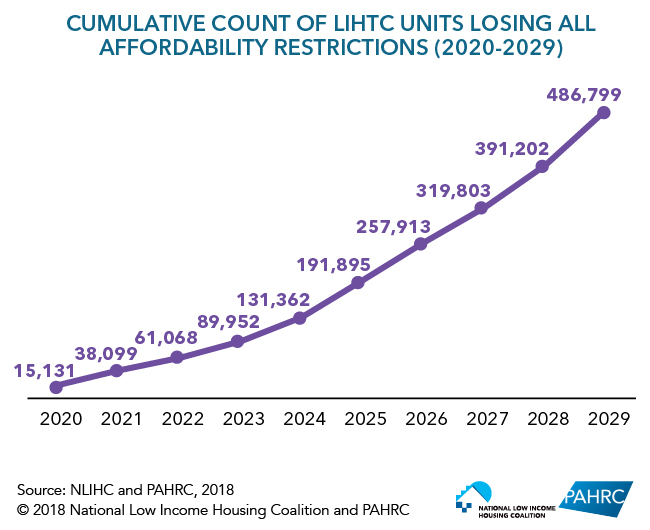

To reduce the overall subsidy cost, Congress originally set the minimum affordability term for LIHTC units to 30 years. Three decades later, many developments are beginning to reach the end of these restrictions. This “loss” rate will only increase as years go on: by 2030, nearly half a million LIHTC units will have phased out of the program according to a new report from NLIHC .

Without new subsidies, these homes are at risk of falling out of the affordable housing stock, either by converting to market-rate or physically deteriorating. To ensure no net loss of affordable units—and increase the supply to the actual need—the National Low Income Housing Coalition (NLIHC) recommends a vast expansion of the housing safety net.

Visit the National Low Income Housing Coalition for more information.

Also, for news and resources for affordable housing initiatives and availability, visit www.housingvirginia.org